GUEST BLOG: Water arrears – many people still struggling with the basics

Grace Brownfield – Senior Public Policy Advocate at StepChange Debt Charity – explains how many people seeking help with debts are struggling to afford the very basics, including water bills.

Falling behind on essential household expenditure – like a water or energy bill – can be a clear indication that someone is in financial difficulty. Last year, 2 in 5 people who came to StepChange Debt Charity for help were behind on at least one household bill – that’s 140,000 people.

StepChange’s new briefing Behind on the Basics (pdf) opens in new window examines which households were most at risk of falling behind on their household bills, and why. However, when considering this we also wanted to look specifically at certain bills – like water bills – to understand the trends in different sectors and whether there was anything we could learn as a result.

Water arrears in 2017

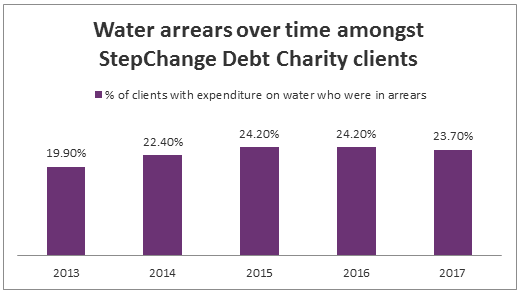

When it comes to arrears on water bills, the picture is mixed. In 2017, 23.7% of StepChange clients who had responsibility for paying a water bill were behind on this. This is an increase from 2013 when 19.9% were in arrears.

However, in recent years, the proportion of people in arrears has levelled out, and the 2017 rate did actually represent an – albeit small – drop from the two years before. This could reflect some of the positive work that is being done across the sector to support people struggling to pay, and to move those who are eligible onto social tariffs to reduce the costs they have to meet.

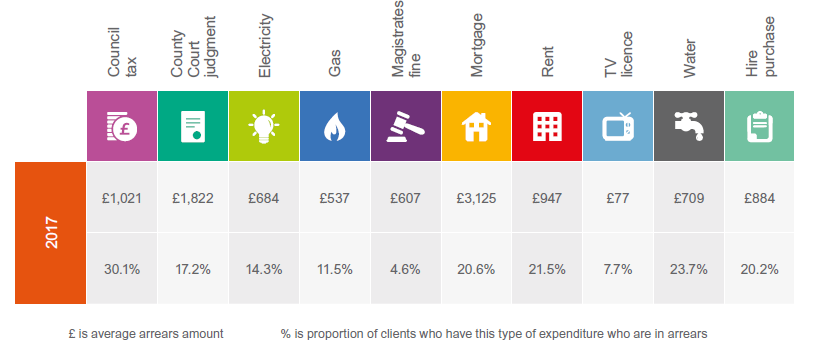

However, it is important not to be complacent. Over the same time period, the average amount of water arrears of StepChange clients increased – from £574 in 2013 to £709 in 2017.

Initiatives such as social tariffs have particular importance, given that our analysis found that spending on essentials makes up a significant proportion of households’ budgets – particularly for those on the lowest incomes – leaving little money to afford other things such as clothing, school uniforms, travel, or household goods.

StepChange clients on the lowest incomes (under £10,000 net household income), spent, on average, 93% of their monthly income just paying their essential household bills and buying food. A continuing focus on affordability, particularly for these households, is therefore very welcome.

Which households were most at risk?

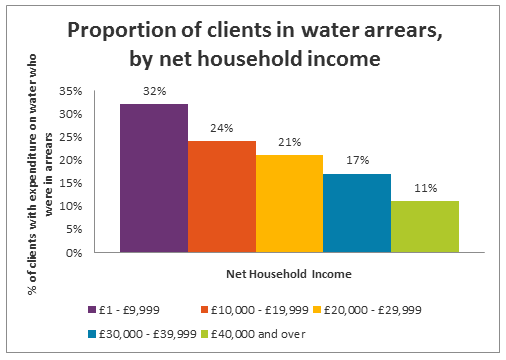

As the above analysis suggests, lower income households were particularly likely to be struggling with their water bill. We found a clear correlation between income level and the proportion of people in arrears.

We also found that single parent households had the highest rate of arrears amongst any family type, and that renters were more likely to be struggling with arrears compared to those with mortgages, or who owned their property outright.

Preventing people from falling behind on the basics

The experiences of StepChange clients set out in Behind on the Basics (pdf) opens in new window reveal there is still more to be done to ensure people can afford their essential bills – including their water bills.

Part of this is a challenge to policymakers, to make sure people have enough money coming in to make ends meet. However, the water industry have also shown they can make a huge difference by helping customers in financial hardship. The key now is to build on this positive work, to make sure customers know what help is available and are encouraged to take it up, and to consider what more might be done to help. We look forward to continuing to work with the industry and others to achieve this.